Last week a New York real estate developer went on CNBC and said, “I didn’t foresee the trend towards work-from-home becoming permanent. Zooming became a thing and I still didn’t see it. Even last year I was pretty sure everyone would go back to the office. Now I have to dump my building at 32 cents on the dollar. I’m an idiot.”

Just kidding. What they actually say is “We have returned the building to the lenders.”

There’s a lot of that happening right now.

Kalshi's Market:

Kalshi’s markets on residential and commercial real estate mortgage defaults provide a hedging mechanism right at the heart of the most debated issue of the year: are we going to get away with a soft landing, or has the rapid reversal of interest rate policy generated widespread new risk?

These markets allow investors to position themselves as to whether there will be an increase in defaults, from Q2 to Q3, as reported by the Federal Reserve. The Q2 rate was reported on August 22, and the Q3 rate can be expected towards the end of November. Market participants are urged to read the Fed’s accompanying explanation. Remember that the Fed figures used for this market are seasonally adjusted.

Commentary:

Although both exist in the same interest rate environment, the commercial and residential mortgage markets are subject to quite different socio-economic forces at the moment.

Commercial BuildingsCommercial real estate default rates have been rising since Q3 of last year, but not at an alarming rate… yet.

https://www.federalreserve.gov/releases/chargeoff/delallsa.htm

Doesn’t look too bad, right? Well, there is, according to one well-known real estate guy, a “category 5 hurricane” coming for the commercial real estate debt market. Commercial real estate lenders have “all but turned off the spigot.”

It’s not hard to understand:

Having got a taste of working from home, US office workers are strongly resisting a return to the office. Rapid evolution of remote-working technology makes this viable.

So large employers are shrinking their office space and not renewing leases.

The resulting cash flow decline for building owners comes just as their loan rates are climbing.

There’s a cascade effect: even buildings that are currently cash flow positive are vulnerable as empty buildings slash lease rates.

ResidentialThe residential market is different. Homeowners who took out a standard 30-year loan in the good years leading up to 2021– when inflation was dead and banks were giving away money – are sitting pretty. As long as they sit still. One national real estate company describes them as “trapped in their homes” because if they move they have to give up their sweet 2-4% mortgage and take a new one at 6-7%, basically doubling their monthly payments.

Agents say that’s the dynamic underpinning residential home prices at the moment. This may be why default rates in the residential market did not rise in Q2 over Q1.

Can that last? Consumers were said to be in great shape after years of low interest rates, a few rounds of free money from the government, and fewer ways to spend it during the lockdowns. That picture is changing: inflation has skyrocketed living expenses, student loan interest charges are coming off pause, and that home equity loan for your patio upgrade is going to cost you 9%. The measure of this is in record credit card debt, which is really not a good sign.

Data from the https://www.federalreserve.gov/releases/chargeoff/delallsa.htm

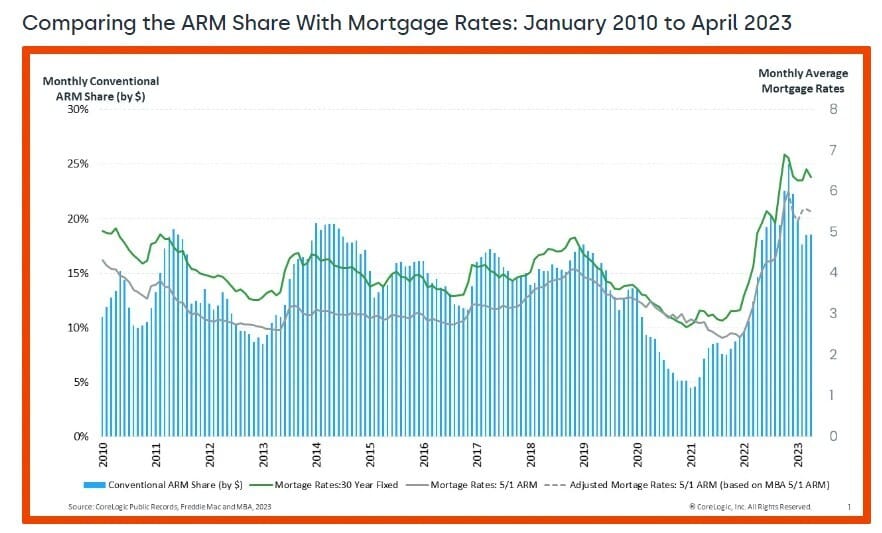

What about Adjustable-Rate Mortgages (ARMs)? : In 2021 the uptake of ARM mortgages fell to a 10-year low, at under 5% of all residential mortgages. As rates have risen, ARM uptake has spiked up – to a high of over 20% last year. This implies that rate re-sets will probably not begin surging until 2026 and thus should not materially affect this Kalshi market.

Source: CoreLogic

Conclusion

Commercial-scale development has always been a kind of Mexican standoff between developers and their bankers. Both parties know that the developer is structured to declare bankruptcy if the building in question turns out not to be as popular as he or she thought.

They’re both trying to read the future. When there’s a major pattern change in how people live and work, the winner/loser ratio blows through standard deviations.

This is how it looked post-GFC.

Left side of box: Residential. Right side of box: Commercial Delinquency rates per quarter. https://www.federalreserve.gov/releases/chargeoff/delallsa.htm

Data from the https://www.federalreserve.gov/releases/chargeoff/delallsa.htm

We don’t have to go to the extremes of the post-GFC era to have substantial pain. A doubling of current real estate default rates would re-raise all the doubts about banking stability that were around in April and May this year.

These default markets on Kalshi offer a unique opportunity for positioning on a macro level.

Disclaimer: The opinions and perspectives presented in this article belong solely to the author(s). Kalshi does not provide investment or trading advice or make any other claim to the veracity of the contents described herein and provides this article solely for the convenience of its members.