Elon Musk’s chances of becoming the world’s first trillionaire have risen to 44%, according to Kalshi’s prediction market tracking the milestone. The bump came after Tesla shareholders approved a new pay package valued at up to $1 trillion, a move that cements Musk’s influence at the company and renews debate over executive compensation and corporate growth targets.

The plan, backed by more than 75% of investors, ties Musk’s payout to steep performance goals. Tesla would need to reach a market capitalization of $8.5 trillion, more than six times its current value, while meeting production milestones such as deploying one million Robotaxis and delivering one million humanoid robots over the next decade, according to ABC News.

Market reaction:

Following the vote, related Musk markets on Kalshi moved higher. In “Who will be the world’s first trillionaire?”, widening his lead over Mark Zuckerberg (8%), Bernard Arnault (6%), and Jeff Bezos (5%).

Another contract, “Wealthiest person in the world this year”, shows traders maintaining near-consensus that Musk will retain the top spot in 2025, with 88% odds, compared with 10% for Larry Ellison.

The three markets together suggest that traders interpret the compensation plan not as a short-term stock catalyst but as an important long-term alignment between Musk and Tesla’s growth potential.

The richest person gets richer

The newly approved deal makes Musk the highest-compensated CEO ever, potentially boosting his Tesla ownership to nearly 29%, according to ABC News. His current net worth sits around $504 billion, per Forbes. If Tesla’s valuation meets its upper targets, Musk’s wealth could more than double, lifting him past the $1 trillion mark within the decade.

As Axios reported, the vote effectively replaces a 2018 compensation plan that was struck down by a Delaware court earlier this year. The new package, which faced opposition from Norway’s $2 trillion sovereign wealth fund, is designed to renew shareholder approval with stricter disclosure standards.

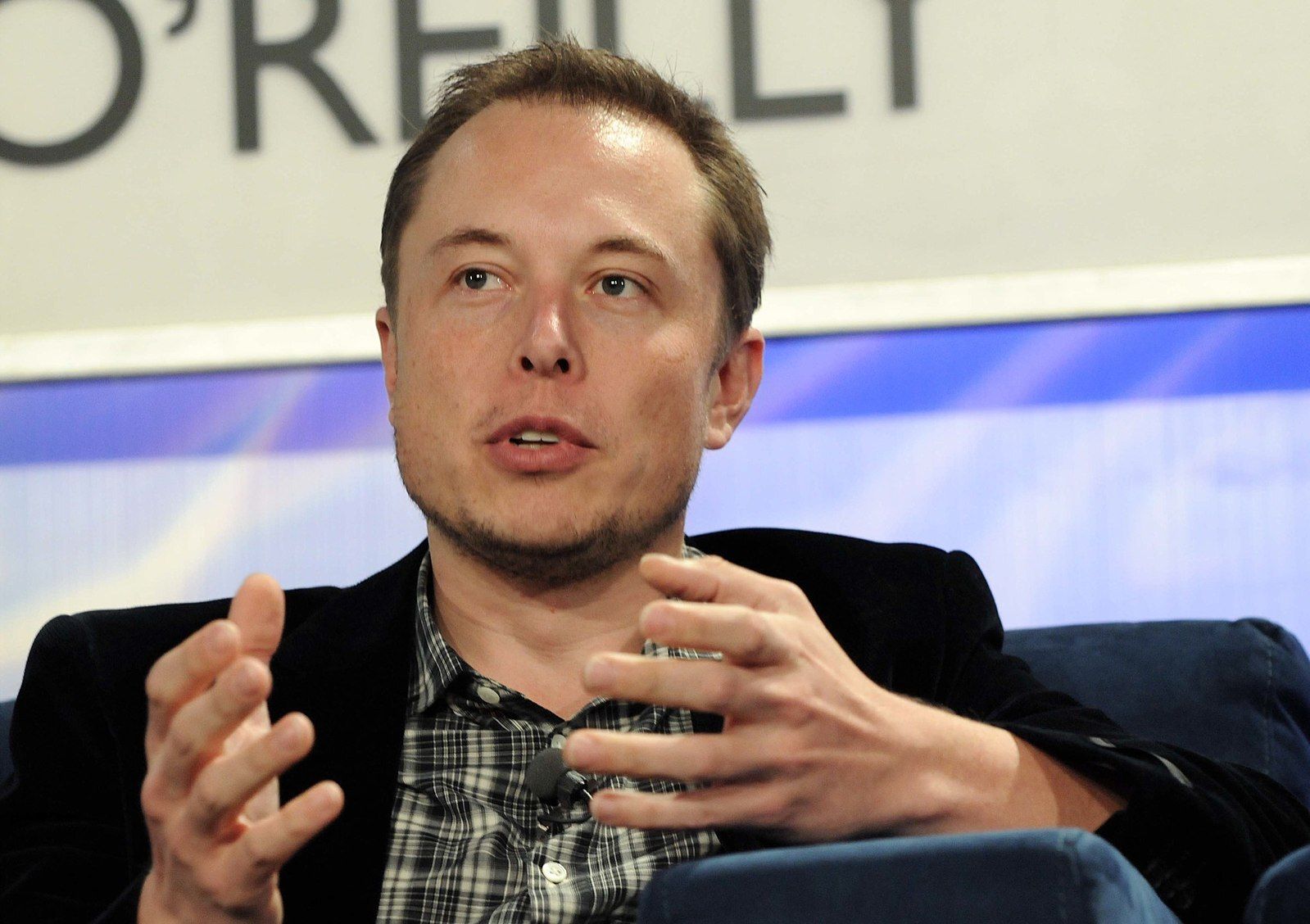

“I’d like to give a heartfelt thanks to everyone who supported the shareholder votes,” Musk said Thursday. “I super appreciate it.”

Wedbush analyst Dan Ives called the result “a clear positive” for Tesla, noting that Musk’s leadership is considered central to the company’s long-term innovation strategy in AI and robotics.

A polarizing decision

Still, critics have questioned the scale of the award. Norges Bank Investment Management said it voted against the plan, citing “dilution” and the risks of over-reliance on a single executive. Tesla’s board chair, Robyn Denholm, had warned shareholders before the vote that Musk could shift focus to other ventures if the deal failed.

Tesla shares are up 16% year to date, roughly in line with the broader market, despite recent earnings pressure. The company reported 12% revenue growth in the third quarter but missed profit expectations. Analysts say the compensation structure could help stabilize investor sentiment by linking Musk’s potential payout to sustained performance rather than one-time stock spikes.

The takeaway

Kalshi traders currently forecast:

The data suggests markets view Musk’s pay approval as a reinforcing signal rather than a transformative event. Traders appear to be pricing in confidence that Musk will remain central to Tesla’s leadership and that his wealth trajectory continues to outpace peers.

Whether Tesla achieves its lofty $8.5 trillion target or not, the prediction markets indicate a broad consensus: Musk remains the clear favorite to make financial history.

This article may contain content generated with the assistance of artificial intelligence. It is provided for informational purposes only and does not constitute investment, trading, financial, or legal advice. Any opinions or market commentary are not recommendations. Trading involves risk, and you should carefully evaluate your financial situation and consult a qualified advisor before making any trading decisions.