Introduction

Political prediction markets are increasingly popular tools for understanding elections, policy outcomes, and major political events. Unlike polls or expert commentary, these markets allow participants to trade on real-world outcomes, turning collective expectations into live, constantly updating probabilities.

For readers familiar with polls but new to these markets, prediction markets like Kalshi, Polymarket, and PredictIt offer a different lens. Prices shift as new information emerges, incentives reward accuracy, and probabilities adjust in real time. Rather than waiting for new polls or relying on media and campaign narratives, prediction markets show how odds and expectations are changing almost instantaneously.

Political prediction markets have grown in visibility as analysts, journalists, and everyday citizens recognize their predictive power. They aggregate diverse information into a single, easy-to-read price. In this guide, we’ll explain how political prediction markets work, how to interpret probabilities, and how to analyze movements using real-world election examples on Kalshi.

If you understand how these markets work, you can get a better sense of what is likely to happen, and even impress your friends with your political predictions, without ever having to put a dollar down. Furthermore, you can become a political savant with the ability to parse through the political noise and focus on what really matters by basing your political analysis in markets instead of narratives.

What Are Political Prediction Markets?

Prediction markets like Kalshi are marketplaces where participants trade contracts tied to specific political events. Each contract corresponds to a clear yes-or-no question, such as whether a candidate will win an election, which party will control Congress, or whether a policy initiative will pass.

These contracts typically settle at $1 if the event occurs and $0 if it does not. Trading prices fluctuate between these values, reflecting the collective probability that the event will happen. For example, a contract priced at $0.65 implies the market believes there is roughly a 65% chance of that outcome.

Unlike polls, which capture opinions at a single moment, political prediction markets update continuously in the run-up to an election. Traders respond to new information (debates, fundraising reports, scandals, voter sentiment, and legal developments) and adjust odds in real time.

A Turning Point for U.S. Political Forecasting

Political prediction markets exist globally across a range of regulatory environments (e.g., PredictIt, Kalshi, Polymarket, and Interactive Brokers). In the United States, these markets entered a new phase in September 2024, when Kalshi, the largest Commodity Futures Trading Commission (CFTC)-regulated exchange, successfully challenged restrictions on election-related contracts. This legal victory opened a regulated pathway for Americans to participate in political forecasting markets under federal oversight just in time for the 2024 Election between Donald Trump and Kamala Harris.

This turning point made Kalshi a central platform for U.S. political prediction markets, providing a transparent, regulated venue where probabilities are set directly by market participants rather than surveys or editorial judgment. For beginners, this means you can observe how a wide range of people interpret political events without needing to master market mechanics.

How political prediction markets work

Contracts and outcomes

Each market asks a clear yes-or-no question. Examples include:

Each contract settles at $1 if the outcome occurs and $0 if it does not. Traders buy and sell based on how likely they believe the event is before resolution. The price at any moment reflects the market’s collective probability, combining all participant expectations into a single signal.

Trading, not gambling

Political prediction markets are sometimes referred to as "political betting" sites. However, this is a misnomer, since trading on exchanges like Kalshi differs from gambling through sportsbooks in a variety of important ways.

For example, as mentioned above, Kalshi is a CFTC-regulated exchange specializing in event contracts. Trading these derivatives is more akin to trading commodity futures, or other futures trading, rather than gambling or sports betting.

Unlike with sportsbooks, prediction markets users are not trading against the exchange. Instead, they are trading against other users, and the exchange acts as a middleman to facilitate the trades, and has no vested interest in the outcome.

Who sets the price?

Another way in which political prediction markets differ from placing a wager through sportsbooks is that these exchanges do not act as a "house." In other words, with Kalshi, Polymarket, or PredictIt, there is no central authority setting prices. Instead prices are determined collectively by traders buying and selling contracts based on their beliefs.

When many participants believe an outcome is likely, demand for “Yes” contracts rises and prices increase. When confidence falls, sellers push prices down. The result is a constantly updating reflection of how financially incentivized traders assess the likely outcome of the event.

This decentralized price formation improves accuracy and reduces reliance on any single source of authority. Rather than depending on political actors, media narratives, or individual analysts, each with their own incentives, prediction markets aggregate many independent viewpoints into one transparent signal.

Who participates?

Political prediction markets attract a wide range of participants, from casual political observers to professional analysts. Below are a few common trader archetypes:

Polling- and data-driven traders focus on polling averages, historical election results, and short- and long-term political trends.

Fundamentals-focused traders analyze campaign mechanics such as fundraising strength, staffing quality, advertising strategy, turnout models, and demographic composition.

On-the-ground observers weigh qualitative signals like rally sizes, volunteer activity, local political signage, and anecdotal impressions from their communities.

News- and event-driven traders react quickly to real-time developments, including debates, scandals, gaffes, endorsements, and major media coverage.

Intuition- or signal-based traders rely on unconventional indicators such as social media sentiment, local enthusiasm, “street-level” observations, or personal judgment.

There is no single correct approach. The market price aggregates all these perspectives, producing a continuously updated probability that reflects the collective judgment of participants. Academic research shows that this collective wisdom of the crowd tends to be a more accurate forecast, especially when it comes to presidential elections.

How to analyze market movements

Understand the probability: Yes vs. no

A defining feature of prediction markets is that price equals probability.

A contract trading at $0.65 implies a 65% chance of the event occurring.

A contract at $0.30 implies a 30% chance.

For example, if a 2028 presidential candidate’s contract trades at $0.58, the market is assigning a 58% chance of victory based on available information.

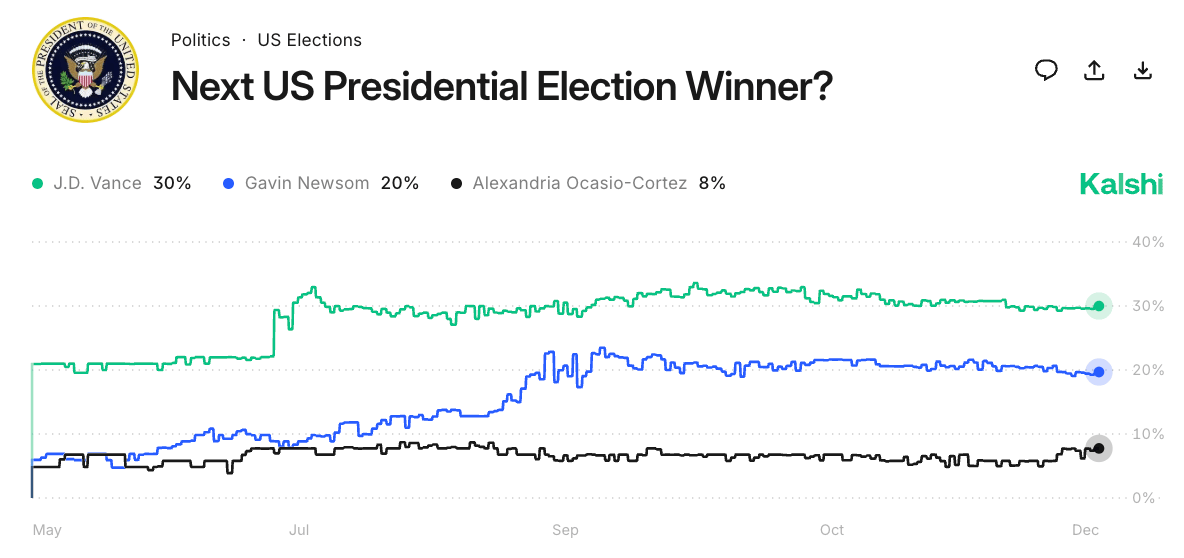

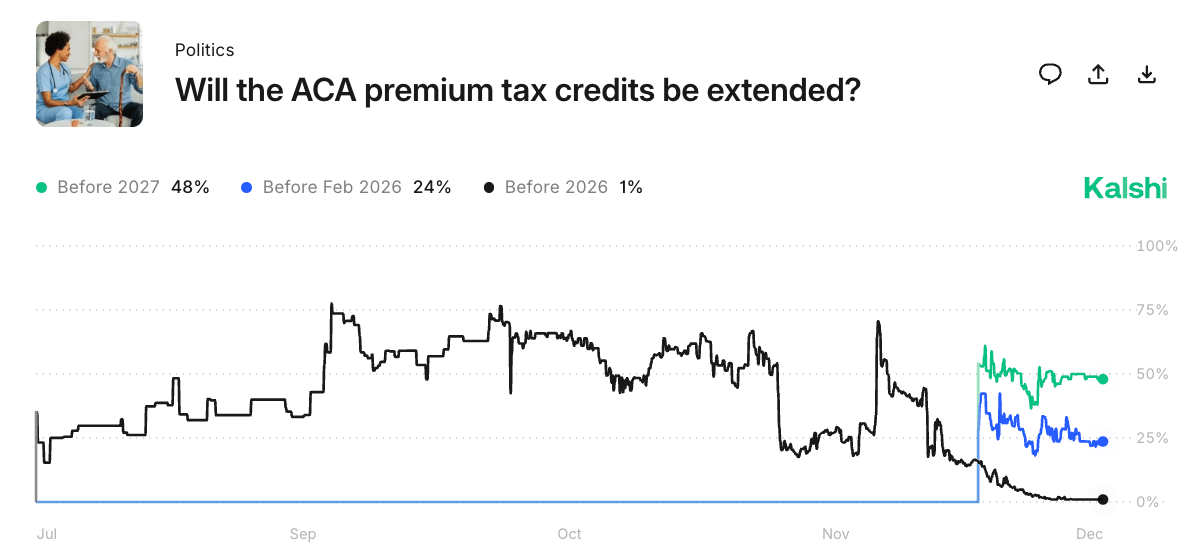

Reading market charts and price signals

Market charts show how probabilities evolve over time, revealing how traders collectively respond to political events. Watching these price changes helps readers understand shifts in expectations as new information emerges.

Sharp moves typically follow breaking news, such as debates, scandals, endorsements, or major announcements. Slower trends often reflect gradual changes in sentiment, driven by factors like turnout expectations, campaign execution, or broader political conditions.

Because traders are financially incentivized to be accurate, these price movements serve as powerful information signals. In many cases, markets adjust faster than polls, offering earlier insight into changing political expectations.

Analyze the resolution rules

Every contract has specific settlement criteria. Understanding these rules is essential:

Contracts must define which sources determine outcomes

Timing of official certifications or recounts must be clear

Rules must account for black swan events (e.g. a Senator switches parties to caucus with the opposition party)

Knowing these rules ensures participants understand exactly how and when probabilities become final results and makes the price signal more valuable to evaluating real probabilities.

Political prediction markets vs. polls

Polls are backward-looking

Traditional polls capture opinions at a single point in time. By design, polling data is often days or weeks old when published. Major campaign events, such as scandals or debate performances, can rapidly change voter expectations before polls reflect that shift.

Prediction markets overcome this lag. Traders adjust probabilities immediately as new information emerges, allowing markets to reflect sentiment in real time. Prediction markets can be especially valuable in primary races and close elections, where late momentum can decide outcomes. Moreover, on election night when the results are coming in, prediction markets are the go-to source for the most up-to-date information on who is most likely to win.

Incentives and accuracy

Poll respondents have no financial incentive to be accurate. Traders, by contrast, risk their own money. This incentive structure encourages careful analysis and rapid updates. Markets can also account for known polling issues, such as underrepresented demographics or historically mismeasured candidates.

Some polls are funded by campaigns or partisan organizations and are designed to shape narratives rather than measure reality. Prediction markets absorb these polls as just one input, adjusting prices based on perceived credibility.

Transparency and collective wisdom

Prediction markets combine polling data, campaign fundamentals, anecdotal observations, and historical context into a single transparent price. This aggregation often outperforms individual polls or expert forecasts, particularly in fast-moving or high-uncertainty situations. Further, prediction markets allow casual political observers to save time poring over the credibility of individual polls.

Candidates like Donald Trump have historically been underpolled in key races, highlighting structural survey biases. Markets allow participants to incorporate this knowledge directly, producing probabilities that can be more accurate and timely.

Conclusion

Political prediction markets provide a real-time lens on political events, complementing polls and media coverage. By aggregating diverse inputs (polls, campaign fundamentals, on-the-ground observations, and breaking news), markets produce a single probability that evolves as events unfold.

After President Biden’s poor debate performance in 2024, prediction markets adjusted immediately, while polls took days to reflect public reaction. Without markets, observers would have been largely dependent on media narratives, which can lag or misrepresent voter sentiment.

With the legalization of regulated election contracts in 2024, Kalshi has become the central platform for U.S. political prediction markets. For those looking to understand elections beyond backward-looking indicators, prediction markets offer a clearer, faster view of how expectations are shifting in real time. You can check out the latest political market odds on Kalshi here.

This content is provided for informational and educational purposes only and should not be construed as investment, trading, financial, or legal advice. Trading on Kalshi involves risk and you should carefully consider your financial situation and consult with a qualified advisor before making any trading decisions. Past performance is not indicative of future results.