Federal Reserve Chair Jerome Powell’s FOMC press conference on Wednesday sent an immediate ripple through interest rate markets, and Kalshi traders wasted no time adjusting.

Following the Fed’s decision to cut its benchmark rate by a quarter point to a range between 3.75% and 4%, Powell attempted to tamp down expectations of another move at the central bank’s final meeting in December.

“A further reduction in the policy rate at the December meeting is not a foregone conclusion” Powell said, emphasizing that policymakers held “strongly different views” about how to proceed in December, according to The Wall Street Journal.

Powell’s comments proved to be market-moving.

On Kalshi, the event market asking whether the Fed will cut rates again in December saw a sharp repricing. Odds of another 25-basis-point cut dropped to 71%, down 17 points on the day, while the chance that the Fed holds steady jumped to 30%, up 19 points. Traders now assign just a 3% probability to a larger move.

The shift reflects traders’ acknowledgment that Powell and his colleagues may be nearing the end of their rate-cutting cycle, even as the data blackout caused by the government shutdown leaves officials flying partly blind.

“The easiest part of unwinding the central bank’s aggressive rate increases may be over,” WSJ’s Nick Timiraos reported, noting that officials are divided over how much further to go. The Fed’s 10–2 vote included one dissent for no change and another calling for a half-point reduction.

Traders still price three total cuts in 2025

Despite Wednesday’s pullback, markets still expect the Fed to deliver three cuts total this year, including the two already completed. Kalshi’s Number of rate cuts in 2025? market shows a 71% chance of exactly three, while odds of just two have climbed to 28%, up 13 points since Powell’s remarks.

That pricing implies traders see the December meeting as a coin toss weighted toward one final quarter-point reduction, though with growing skepticism about whether Powell will want to extend the easing cycle without stronger evidence of labor market weakness.

The Fed’s challenge is compounded by missing economic data. With the government shutdown halting reports on jobs and spending, policymakers are left to interpret limited signals about hiring, inflation, and credit conditions. “You’d be worried as a policymaker that something’s happening and you’re just missing it,” former Fed adviser William English told the WSJ.

Why it matters

Stock indices briefly rallied on the decision before turning lower as Powell spoke. The Dow and S&P 500 lost ground, while Treasury yields rose, signs that investors interpreted the chair’s comments as a subtle tightening of expectations.

The data blackout, combined with the Fed’s decision to halt its balance-sheet runoff in December, has injected unusual uncertainty into the year-end outlook. While the central bank continues to signal caution, Kalshi traders are effectively betting that the current slowdown, especially in hiring and housing, will be enough to justify one more move.

For now, the markets show a soft-landing consensus still intact but fraying at the edges: rate cuts are no longer “on a pre-set course,” as Powell put it, and the odds of standing pat in December are the highest they’ve been since summer.

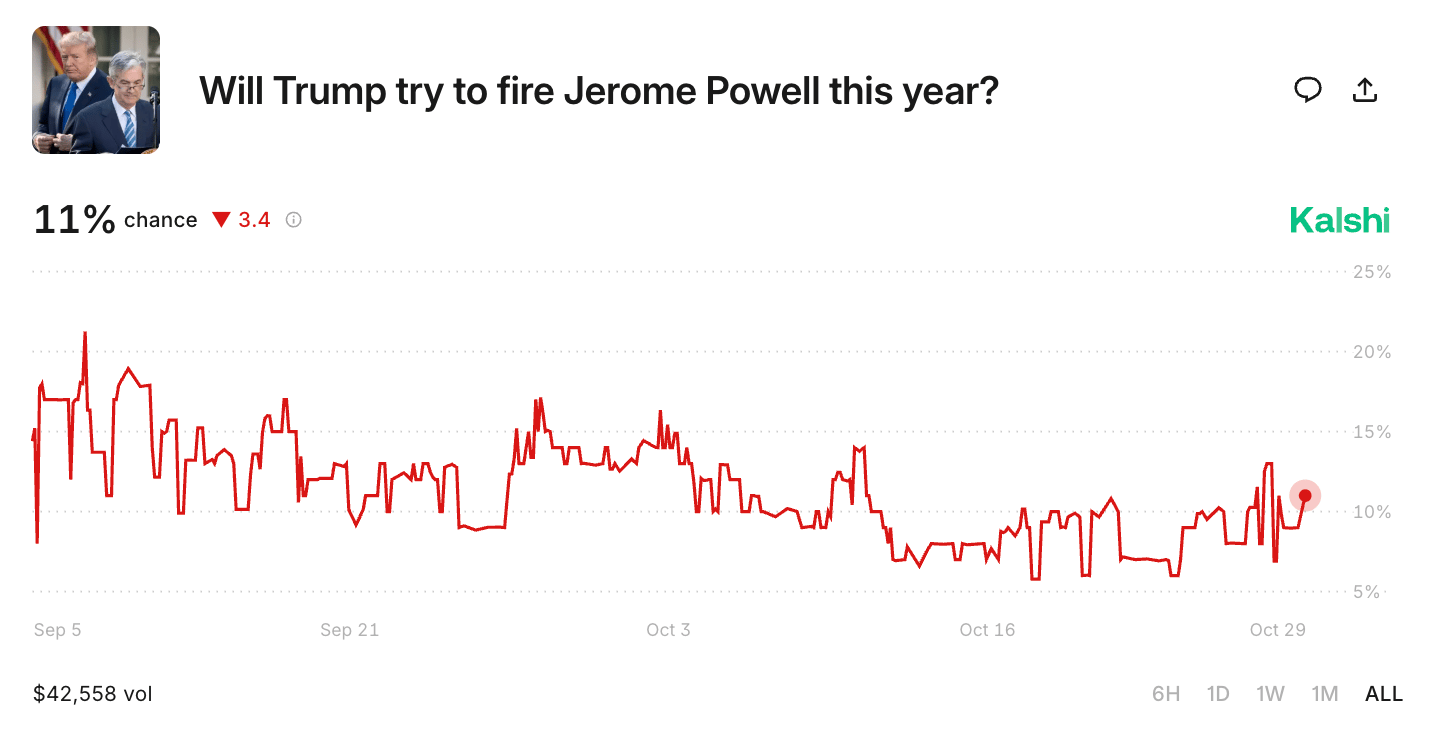

A related Kalshi market tracking whether President Trump will try to fire Jerome Powell this year shows little change, dipping to 11%, down about 3 points on the day.

Sources: Wall Street Journal, Oct. 29, 2025; WSJ Live Coverage, Oct. 29, 2025. Image Source: DSC_8526

This article may contain content generated with the assistance of artificial intelligence. It is provided for informational purposes only and does not constitute investment, trading, financial, or legal advice. Any opinions or market commentary are not recommendations. Trading involves risk and you should carefully evaluate your financial situation and consult a qualified advisor before making any trading decisions.