Superconductor

Markets converge on low-inflation, growth environment

A room-temperature superconductor is possible; market pricing good odds

Growth Report

Fear of a recession all but disappears

Across Kalshi’s markets – inflation, GDP, payroll growth, recession – there has been increasing consensus that we are in soft landing territory. That marks a major departure from recessionary fears which have permeated the public consciousness for more than a year: yield curves have remained inverted; consumer sentiment is shockingly weak compared to economic fundamentals. Part of this increase in certainty among market participants is probably due to more information with which to value year-long 2023 contracts (we’re seven months into the year); but the confidence that Kalshi’s traders have in this is more than that. Odds of a recession (two quarters of negative GDP growth) are at an all-time low of 9%. GDP in Q3 is expected to be a whopping 2.45%. Confirming this, July payrolls data – released today – showed lower than expected but still material job growth (Kalshi estimate: 291k, real number: 187k) and a historically low unemployment rate (Kalshi estimate: 3.59%, real number: 3.5%).

The probability of a 2023 recession is forecasted to be…9%

Two consecutive quarters of negative GDP growth

Inflation Report

Inflation expected to be low in July, and for 2023

Headline inflation in July is expected to be 0.19%, which would round to the same 0.2% print as June. Annualized this rate would bring us to just above 2% inflation. Core inflation is expected to be even lower at 0.14%. This would be the first 0.1% or less core inflation print since February 2021, when the omicron variant peaked, temporarily holding the economy’s recovery back.

These estimates are in stark contrast with the Cleveland Fed’s Nowcast, which currently projects much higher inflation over the next two months, including two consecutive months of 0.4% core inflation. Numbers like that could realign the FOMC’s thoughts about rate hikes, whereas Kalshi’s are more consistent with their current path.

Inflation

Kalshi Jul / Aug

Cleveland Fed Jul / Aug

Headline

0.19 / 0.46

0.41 / 0.60

Core

0.14 / 0.11

0.40 / 0.40

Expected annual inflation has slightly risen from last month 2.92% to 3.04%.

2023 US annual inflation is forecasted to be…3.04%

Fed Fund Rate Report

Stability expected: 50/50 of one more hike this year

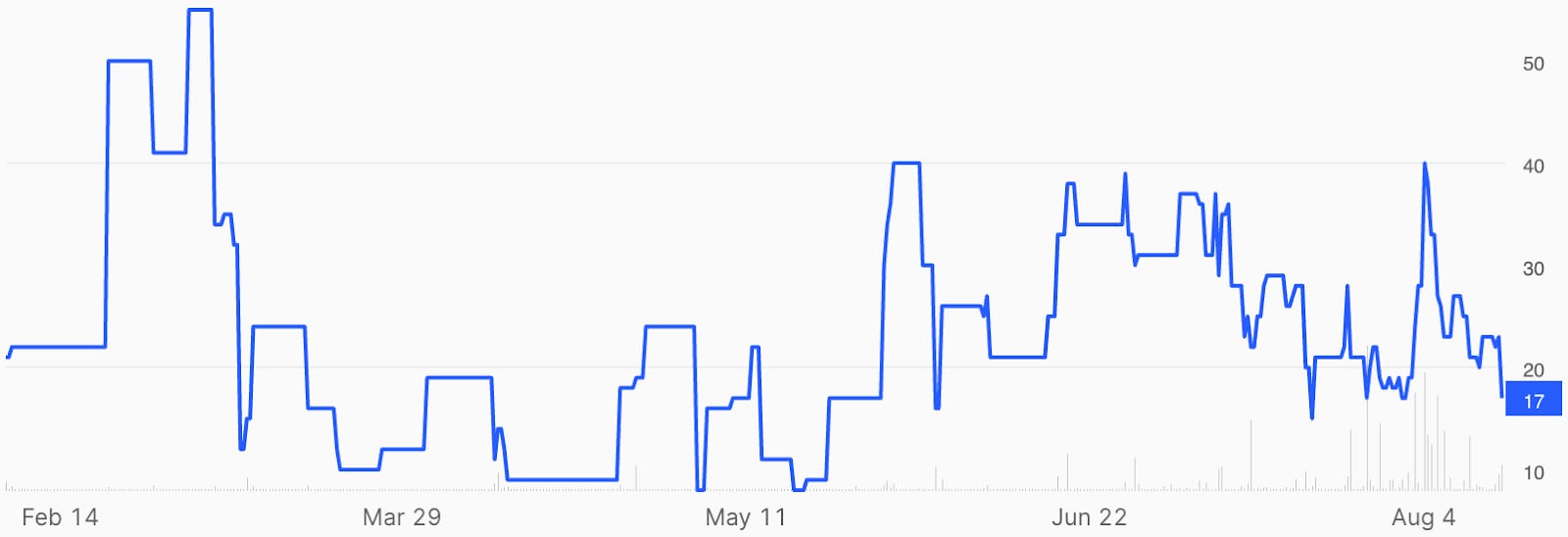

Kalshi markets project the Federal Reserve to stand pat at the September meeting, with only a 17% chance of hiking. Traders have moved the chance of a rate cut to near its lowest ever since the market launched last September at 10%. By year end, Kalshi trades expect a 50-50 chance of another rate hike.

CME’s FedWatch tool has a similar probability of a hike in September (15.5%) and a rate cut by year-end (8.6%) but considerably lower odds of another hike by year-end (at 27%).

Probability of a 25 bp hike in September is 17%

Probability of the target rate range being at least 25bp higher at year end…51%

The probability of a rate cut in 2023...10%

Science Report

Room-temp superconductor possible

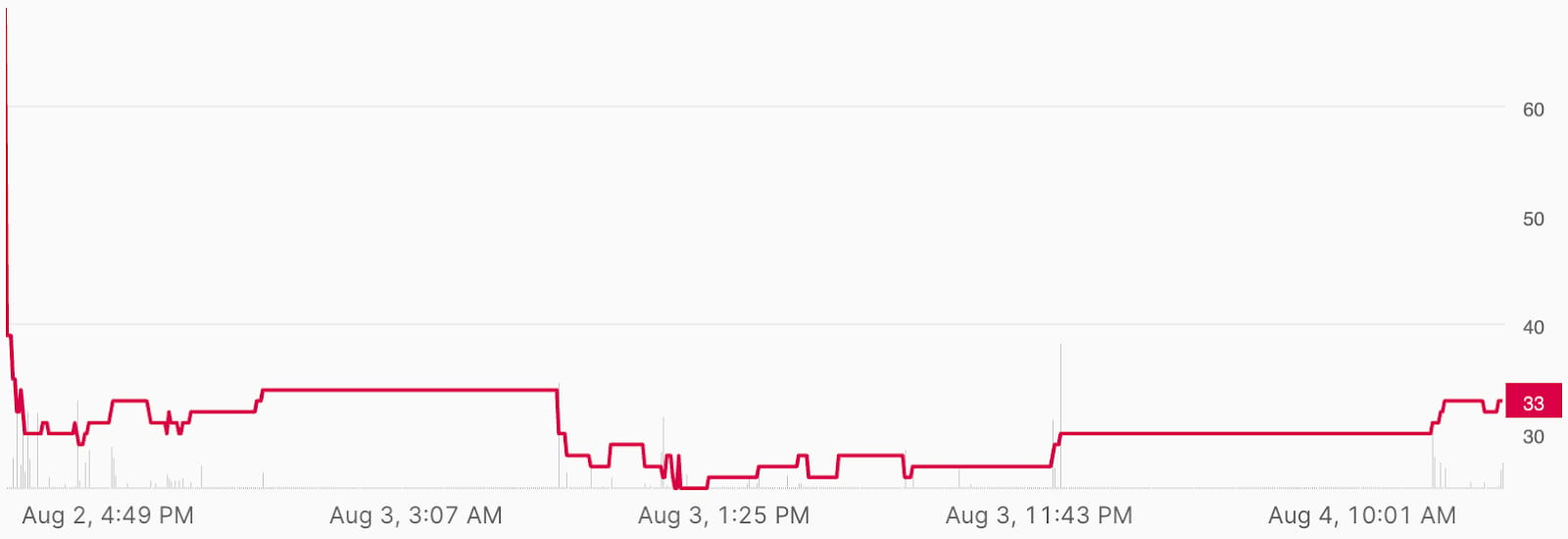

Following a string of misses and retracted papers, two publications out of Korea last week have suggested a serious chance that a new material, LK-99, can operate as a room-temperature superconductor. This would be a massive discovery. In the status quo, a large fraction of energy is lost as it is transmitted (e.g. through metal wires). A superconductor doesn’t lose any of that energy. To date, superconductors found can only operate at extremely cold temperatures, making them impractical. The odds of a room-temperature semiconductor being verified in a major journal are currently 33%.

The probability of a room-temp superconductor being reported in a major journal…33%

About the Kalshi Whisper

The “whisper” number is a private, unofficial number that is circulated by bank analysts to their clients, including high net-worth individuals, Wall Street traders and hedge funds during the blackout period after the official consensus is published and before data is released. Analysts and economists at banks continue to revise their estimates during the blackout period, but share their new forecasts with a limited clientele. They call these late forecasts “whispers” because they’re not public and not broadly accessible. Kalshi forecasts serve as a more accessible market-driven “whisper” during the blackout period, before the release tomorrow.

The Kalshi Whisper comes from market prices based on CPI, core CPI, target fed funds markets and other relevant Kalshi markets. Markets are purely directional: traders purchase binary contracts on a central-limit order book that pay out based on conditions such as “CPI inflation exceeds 0.2% in November 2022”. From these contracts, one can simply extract the probability of any given release. For example, the probability of CPI inflation equaling 0.2% is equal to the price that CPI inflation exceeds 0.1% subtracted by the price of CPI inflation exceeding 0.2%. Current projections are based on the last traded price for contracts. Federal funds rate projections come from binary markets that pay out on the basis of the upper bound of the Federal Funds target range.

Kalshi markets have a history of accuracy. The median Fed projections have correctly identified the size of the rate hike for each meeting since the first Kalshi Fed projection in July 2021. The median CPI forecasts have been equally accurate or more accurate than the Bloomberg economist survey and the Cleveland Fed Nowcast in 11 of the last 13 months.

Disclaimers

This communication is provided for information purposes only. Please read Kalshi research reports related to its contents for more information, including important disclosures.

This communication has been prepared based upon information, including market prices, data, and other information, from sources believed to be reliable, but Kalshi does not warrant its completeness or accuracy except with respect to any disclosures relative to Kalshi and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication.

Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Kalshi’s research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, Kalshi may be restricted from updating information contained in this communication for regulatory or other reasons.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of Kalshi. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitute your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of Kalshi.