March 2023 · Banking chaos scrambles all Fed projections

Fed Fund Rate Report

Fed pause probability surges after bank run

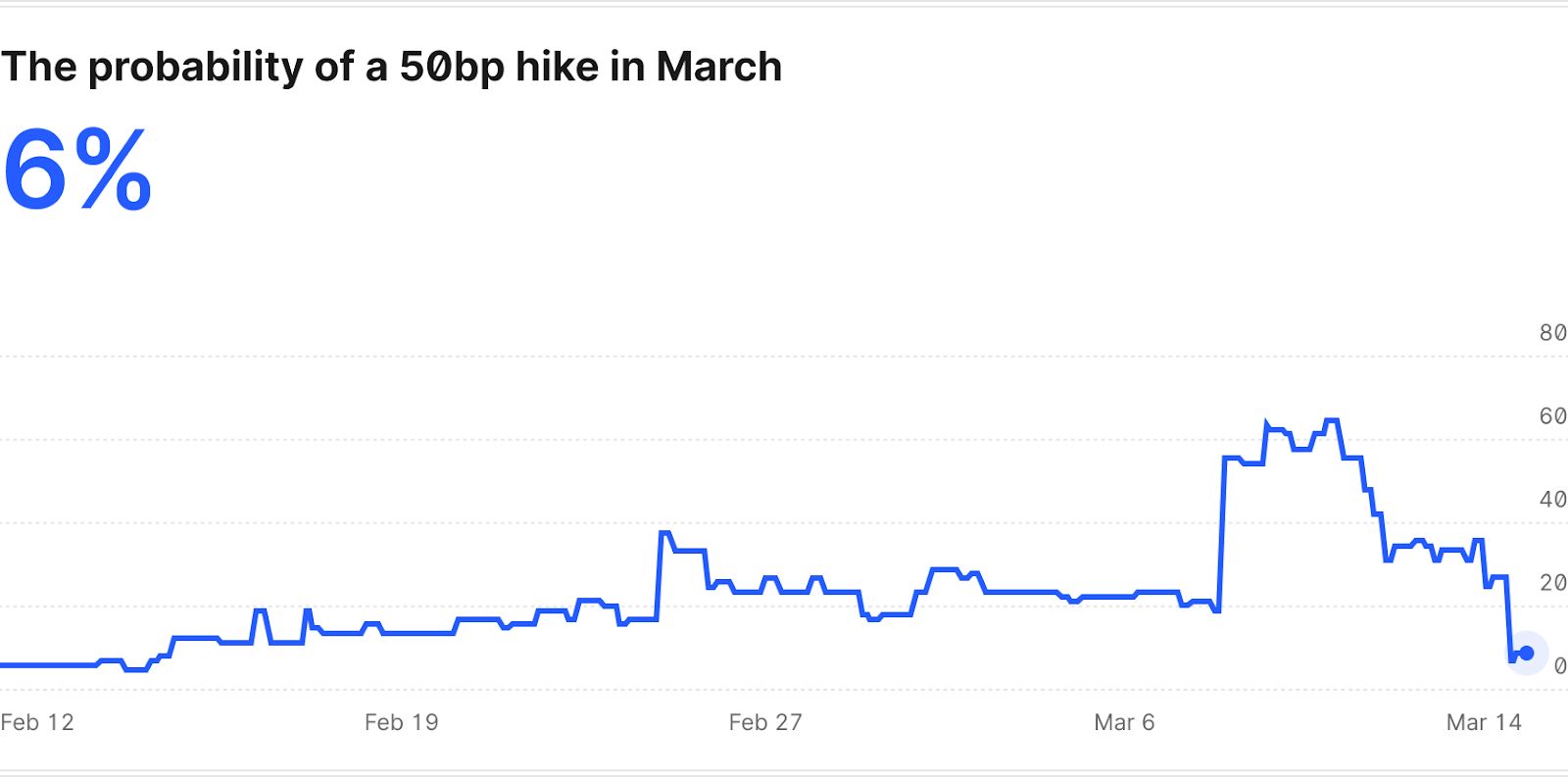

The probability of zero hikes in March has surged to 30% (up from 1% on Thursday) after the release of a report from Goldman Sachs projecting 0 bp worth of hikes at the March meeting. The probability stood at 1% on Thursday and a mere 3% on Sunday morning before surging to 26% soon after the report’s release. It ticked up to 30% on Monday morning. Meanwhile, the probability of a 50 bp hike has cratered to 6%, down from 31% Sunday morning and 57% late Thursday.

The probability of Fed pause in March - 30%

This chart represents the Kalshi markets probability that the fed funds target range will remain at 4.50-4.75% after the March meeting

The probability of a 50 bp hike in March - 6%

The chart here represents the probability of a 50+ bp hike in March

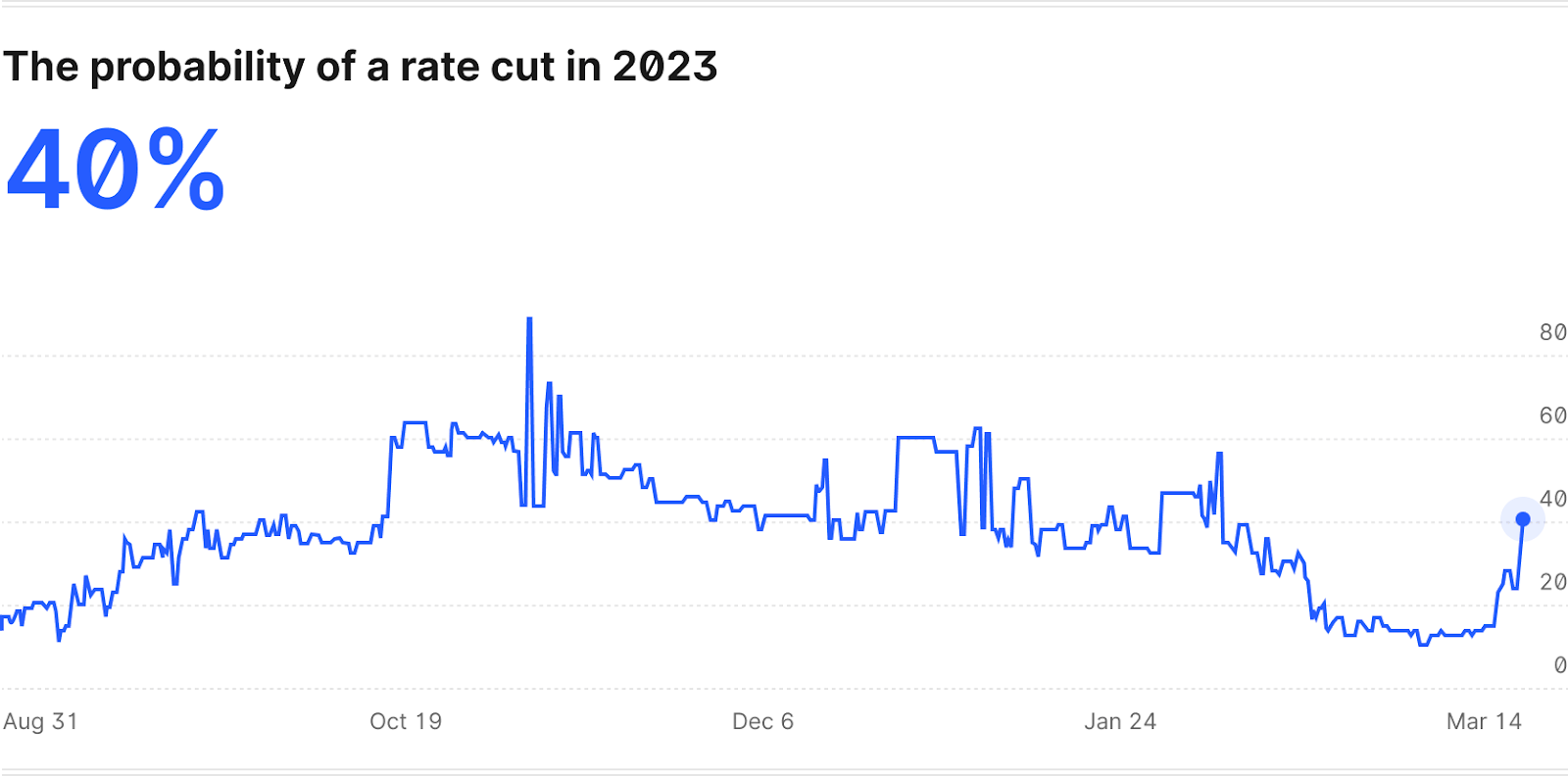

The long-term rate outlook has changed dramatically as well. The probability of a rate cut sometime in 2023 has jumped from 16% on Thursday to 40% today. Meanwhile, the forecasted Fed target range for each meeting has shifted downwards. The May meeting median forecast is now 5.00-5.25%, down from Thursday’s projection of 5.25-5.50%. The June forecast is down even further, from 5.50-5.75% to 5.00-5.25%. The terminal forecast is likewise down to 5.25-5.50%.

The probability of a rate cut in 2023 - 40%

Timeline of the past week

So why the major swings? On Tuesday, Federal Reserve Chairman Jerome Powell told the Senate Banking Committee that “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.” As a result, expectations of hiking surged almost immediately, forecasting (narrowly) a 50 bp hike for March. The forecast for pretty much every meeting rose by roughly 25 bp from their previous projection. All of that changed on Friday with the news of a bank run on Silicon Valley Bank and the subsequent action by California regulators to shut it down and turn over bank ownership to the FDIC. With fears of banking panic spreading, many speculated that the Fed might ease off of the tightening in order to restore confidence in the market, and the probability of a 50 bp hike fell from 57% to 31%. On Sunday, the federal government announced that all uninsured depositors at Silicon Valley Bank would be made whole and Signature Bank would fail as well. Many feared that other mid-sized banks, particularly those exposed to the tech or crypto sectors, might face challenges as well. Those same fears caused Treasury rates to tumble, just as many tech startups worried about the fallout from the SVB and Signature failures began to park their money in Treasuries. After Sunday’s drama, the probability of a zero-hike scenario surged to 30%.

Inflation Report

Bank run overshadows still pivotal inflation report

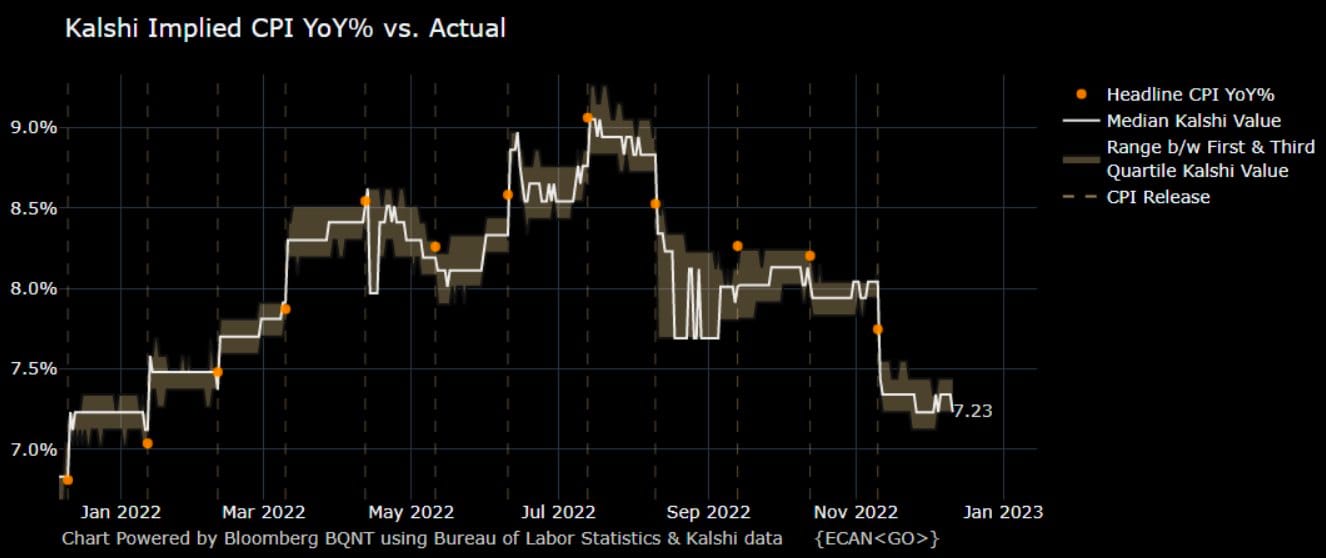

Lost in the chaos of this weekend’s bank run and subsequent federal action is the looming shadow of the February inflation report, due to be released at 8:30 AM ET on Tuesday, March 14. Kalshi markets have kept their forecast for headline CPI inflation (month-over-month) in the month of February at 0.4%. This number is well below the Cleveland Fed’s Inflation Nowcasting tool, which projects 0.54% month-over-month CPI inflation. Expectations of core inflation, which strips out volatile energy and food prices, have remained constant at 0.4% with the probability of 0.5% or above standing at 35%. Annual inflation expectations have increased to 3.56%, the highest value since January 18. These numbers have increased dramatically in recent weeks. After promising data released in January and early February, market forecasts bottomed out at 3.16% before rising over the course of late February and early March.

2023 US annual inflation is forecasted to be…

3.56%

Growth report

Macro outlook unchanged by weekend news

Despite this weekend’s action, the probability of a recession has not changed. Kalshi traders project that there is a 44% chance of two consecutive quarters of negative GDP growth sometime in 2023, which has been roughly stable since November 2022. Kalshi markets do expect the March jobs report to report lower numbers than February and January, with a forecast of 158,000 new jobs created. The Q1 GDP forecast remains unchanged at 2.19%.

The probability of a 2023 recession is forecasted to be…

44%

Two consecutive quarters of negative GDP growthAbout the Kalshi Whisper

The “whisper” number is a private, unofficial number that is circulated by bank analysts to their clients, including high net-worth individuals, Wall Street traders and hedge funds during the blackout period after the official consensus is published and before data is released. Analysts and economists at banks continue to revise their estimates during the blackout period, but share their new forecasts with a limited clientele. They call these late forecasts “whispers” because they’re not public and not broadly accessible. Kalshi forecasts serve as a more accessible market-driven “whisper” during the blackout period, before the release tomorrow.

The Kalshi Whisper comes from market prices based on CPI, core CPI, target fed funds markets and other relevant Kalshi markets. Markets are purely directional: traders purchase binary contracts on a central-limit order book that pay out based on conditions such as “CPI inflation exceeds 0.2% in November 2022”. From these contracts, one can simply extract the probability of any given release. For example, the probability of CPI inflation equaling 0.2% is equal to the price that CPI inflation exceeds 0.1% subtracted by the price of CPI inflation exceeding 0.2%. Current projections are based on the last traded price for contracts. Federal funds rate projections come from binary markets that pay out on the basis of the upper bound of the Federal Funds target range.

Kalshi markets have a history of accuracy. The median Fed projections have correctly identified the size of the rate hike for each meeting since the first Kalshi Fed projection in July 2021. The median CPI forecasts have been equally accurate or more accurate than the Bloomberg economist survey and the Cleveland Fed Nowcast in 10 of the last 12 months.

Disclaimers

This communication is provided for information purposes only. Please read Kalshi research reports related to its contents for more information, including important disclosures.

This communication has been prepared based upon information, including market prices, data, and other information, from sources believed to be reliable, but Kalshi does not warrant its completeness or accuracy except with respect to any disclosures relative to Kalshi and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication.

Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Kalshi’s research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, Kalshi may be restricted from updating information contained in this communication for regulatory or other reasons.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of Kalshi. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitute your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of Kalshi.