Inflation is a measure of how much the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central banks attempt to limit inflation and avoid deflation in order to keep the economy running smoothly. Despite these attempts, there have inevitably been periods of high inflation throughout history.

Inflation trading, thus, is an investment strategy that seeks to profit from these rising prices. High inflation can be detrimental to an economy, as it can lead to uncertainty, discourage investment and saving, and reduce the overall standard of living.

As a result, investors and individuals have often looked for ways to protect their wealth and purchasing power from the effects of inflation. This has led to the development of various financial instruments and strategies that are designed to trade on or hedge against inflation.

Historic Methods of Trading Inflation

Inflation trade is a concept broadly considered when investors believe there is the risk or potential to gain from rising price inflation. In times of rising price inflation, many investors will rotate their portfolios into assets generally more favorable in an inflationary environment. Those assets have historically included:

1. Inflation-protected securities: As their name indicates, these are financial instruments that are designed to protect against inflation. One example is U.S. Treasury Inflation-Protected Securities (TIPS), which are backed by the U.S. government and offer a fixed rate of return that is adjusted for inflation.

When you buy a TIPS, you are lending money to the U.S. government in exchange for a fixed rate of interest. The principal value of your TIPS increases with inflation, so the value of your investment is protected against rising prices. When the TIPS matures, you will receive the adjusted principal value plus the accumulated interest.

For example, let's say you buy a TIPS with a face value of $1,000 and an interest rate of 2%. If the rate of inflation is 3% over the life of the TIPS, the value of your investment will increase by 3% to $1,030. When the TIPS matures, you will receive $1,030 plus the accumulated interest of $20, for a total payout of $1,050.

TIPS can be a good option for investors who are concerned about protecting their purchasing power in the face of rising prices. However, they may not offer the same potential for capital appreciation as other investments, such as stocks.

2. Commodities: Some investors believe that commodities, such as gold or oil, can be a good hedge against inflation due to price fluctuations and their implications. Some of these effects include:

Price increases: The prices of commodities tend to increase when the cost of living goes up. This can be due to the fact that the cost of producing and transporting commodities tends to rise with inflation.

Demand: Inflation can lead to increased demand for certain commodities, particularly those that are seen as a store of value. For example, gold has historically been seen as a safe haven asset and its price may rise during times of economic uncertainty or rising prices.

Diversification: Adding commodities to your investment portfolio can help to diversify your holdings, which can potentially reduce overall portfolio risk.

3. Real estate: Property values can also be affected by inflation, as the cost of building and maintaining real estate tends to increase with inflation. As a result, some investors may consider investing in real estate as a way to protect against inflation.

Real estate could hedge inflation due to a few causes:

Appreciation: As the cost of living increases, the value of real estate may also increase. This can lead to capital appreciation, which is the increase in the value of an asset over time.

Rental income: If you own rental properties, you may be able to increase the rent you charge to tenants as the cost of living increases. This can help to offset the impact of rising prices on your own expenses.

Inflation-adjusted mortgage: If you have an inflation-adjusted mortgage, your monthly payments will increase as the cost of living goes up. This can help to protect your purchasing power, as the value of your mortgage payments will remain constant in real terms (i.e., after accounting for inflation).

4. Stock Market: Albeit quite broad, some investors believe that equities can be a good way to benefit from rising prices. This conviction refers specifically to stocks of companies with strong growth prospects and the ability to raise prices in response to inflation.

The stock market can be a potential hedge against inflation for a few reasons:

Earnings growth: Companies that are able to consistently grow their earnings over time may be able to offset the impact of rising prices on their business. As a result, their stock prices may also rise.

Dividend payments: Some companies pay dividends to their shareholders. As the cost of living increases, these dividend payments may be worth more in real terms (i.e., after accounting for inflation).

Pricing power: Companies with strong brands and a loyal customer base may be able to pass on some of their cost increases to customers by raising prices. This can help to protect their profits and potentially boost their stock price.

However, it's important to note that any of the above investments are subject to a variety of risks, including changes in economic conditions, company-specific risks and market volatility. More, all the above inflation hedges require you to own the underlying investment vehicle. That’s where an inflation event contract comes in.

Trading Inflation via Event Contracts

Unlike traditional financial products, event contracts allow traders to directly profit from their prediction of future inflation, without the middleman investment vehicles above. An event contract on rising inflation represents the probability of that outcome.

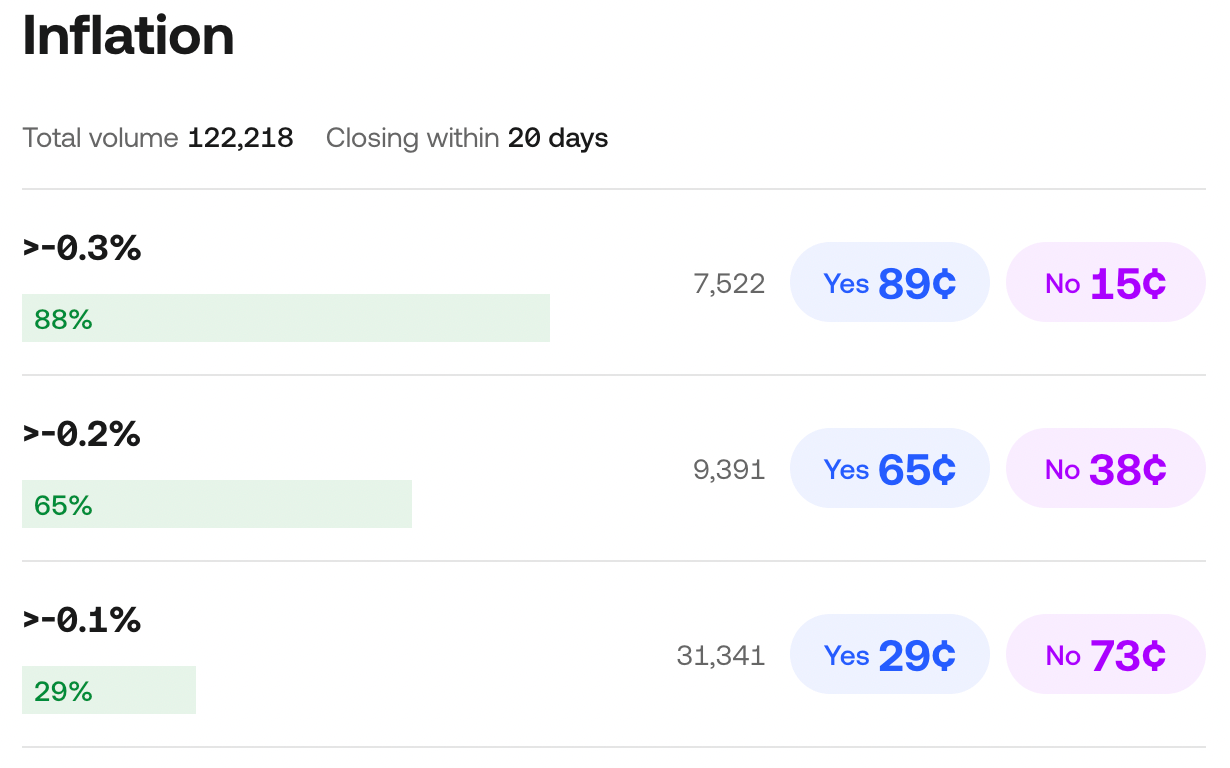

Example: In this event contract below, the order book displays all the resting orders and their corresponding price. As the order book shows, there are 7,522 contracts available on the Yes side for $0.89 each if you believe core month-over-month inflation will increase by more than -0.3%.

To trade inflation with event contracts, an investor would typically buy or sell financial instruments that represent their expectations of future inflation. For example, an investor who expects inflation to increase might buy an inflation futures contract, while an investor who expects inflation to remain stable might sell an inflation futures contract.

Tracking Inflation

The most common economic reports used to measure inflation are the Consumer Price Index (CPI), the Producer Price Index (PPI), and the Personal Consumption Expenditures Price Index.

For comparison, the PCE is a broader measure than the CPI and is weighted based on consumption measures used to derive the gross domestic product rather than on a household spending survey as the CPI. Today, each report has its own unique role and significance in the economy.

CPI measures the weighted average urban consumers pay for a standardized market basket of goods and services. It is reported monthly by the Bureau of Labor Statistics (BLS).

More specifically, the CPI is used to calculate the cost of living adjustment (COLA) for Social Security benefits and to adjust tax brackets and other income thresholds to keep pace with inflation. It is also used by the government to index the payments it makes to beneficiaries of certain programs, such as veterans' benefits and federal pensions. As such, the CPI is important to many people who receive these types of benefits, as well as to those who rely on the stability of their income to make financial decisions.

The CPI is often considered an important economic indicator because it provides a snapshot of changes in the cost of living over time. That’s why Kalshi inflation markets are tied to the CPI. It helps policymakers and analysts understand how changes in the prices of goods and services are affecting households, and can help identify trends in inflation that may have economic and social implications.

To get started learning more about inflation or strategizing a trade, the Inflation Dashboard is where to begin. Here, you can track historic inflation, monitor current forecasts, and see what your inflation forecast should be based on your predictions for the price fluctuations in the CPI’s core categories.

The PCE Price Index, on the other hand, is a broader measure than the CPI of the change in the price of goods and services purchased by consumers. As such, some consider it to be a more accurate measure of inflation. It is used by the Federal Reserve to help guide monetary policy decisions, and is considered an important indicator of the overall health of the economy. It is released monthly by the Bureau of Economic Analysis of the U.S. Department of Commerce.

PPI is a weighted average of prices realized by domestic producers. It includes prices from the first commercial transaction for many products and some services. It is also reported monthly by the BLS.

In general, both the CPI and PCE are important measures of inflation that can have significant implications for individuals and the economy as a whole. All three of these indices provide an alternative "core" reading excluding the more volatile food and energy prices.