2025 has provided a gridiron campaign for the ages. Thankfully, the best is yet to come.

Following an animated opening round, the second leg of the playoffs will take center stage over New Year’s Eve/New Year’s Day.

Round 1 of the college football postseason produced just one upset, highlighted by Miami taking down Texas A&M in a defensive standoff. However, these upcoming contests are shifting to neutral sites, meaning any lopsided home-field advantage will be palliated. This week’s action should split the contenders from the pretenders.

As a reminder, the tournament finale (aka the National Championship) will take place at Hard Rock Stadium on January 19. Until then, let’s continue by analyzing Kalshi’s markets for each game of the second round, all of which will be broadcast on ESPN.

This is an opinion and not financial advice. The author cannot trade on Kalshi.

On the heels of a gutsy victory in College Station, head coach Mario Cristobal will lead No. 10 Miami (11-2) back to Texas for a two-step with No. 2 Ohio State (12-1) on New Year’s Eve. Kickoff at AT&T Stadium is set for 7:30 p.m. ET.

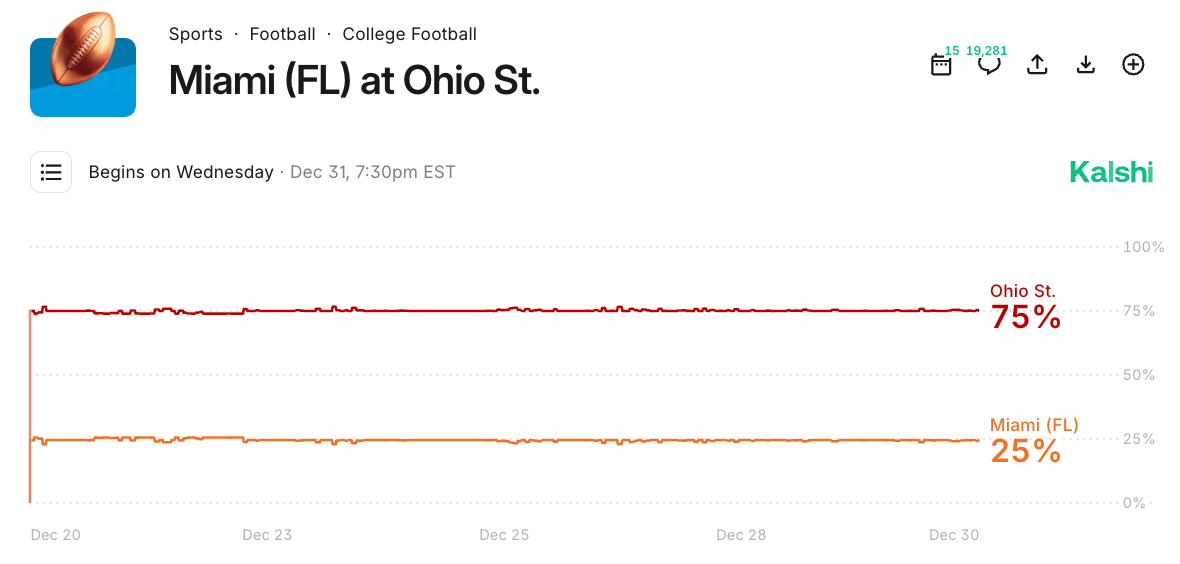

Here we see two proud football institutions pitted against each other. Ohio State is presently yielding a 75% winning likelihood on Kalshi, which is a clip that has remained steady since opening. Traders are also forecasting a spread of 9.5 points for OSU, priced at 51¢. With kickoff swiftly approaching, the total is set at 42.5 points and shows a 48% probability for the over.

Notably, the University of Miami used a swarming defense to advance from the playoff’s opening round. They did well to limit Texas A&M to just three points and less than 90 yards rushing. Be that as it may, the U has an arduous task ahead with its next opponent.

Defending champion Ohio State is coming off its first loss of 2025. After dropping the Big Ten title game to undefeated Indiana, OSU should be eager to return to action. Head coach Ryan Day will need more from his offense and everyone in Columbus knows it. Can true freshman quarterback Julian Sayin (182.1 passer rating) answer the call?

Speaking of offense, Miami and junior signal-caller Carson Beck certainly struggled versus A&M. Beck registered only 103 passing yards while the team managed only 12 first downs. It was sufficient for a win at raucous Kyle Stadium, but they will need more against a stifling OSU defense.

Ohio State showcases the nation’s top defense both in terms of scoring (8.2 PPG) and total yardage allowed (213.5 YPG). The reigning champs have been incredibly dominant against the pass, limiting opponents to only 129.1 YPG through the air.

On ESPN’s SP+ rankings, OSU is viewed as the best football team in the country. Still, Miami (FL) managed to crack the top 10, landing ninth overall. Given the talent on hand, I’d expect another defensive battle.

In what is predicted to be the closest contest of the second-round slate, No. 5 Oregon (12-1) and No. 4 Texas Tech (12-1) will meet in Miami Gardens to lead off the New Year’s Day trifecta. Kickoff at Hard Rock Stadium is scheduled for noon ET.

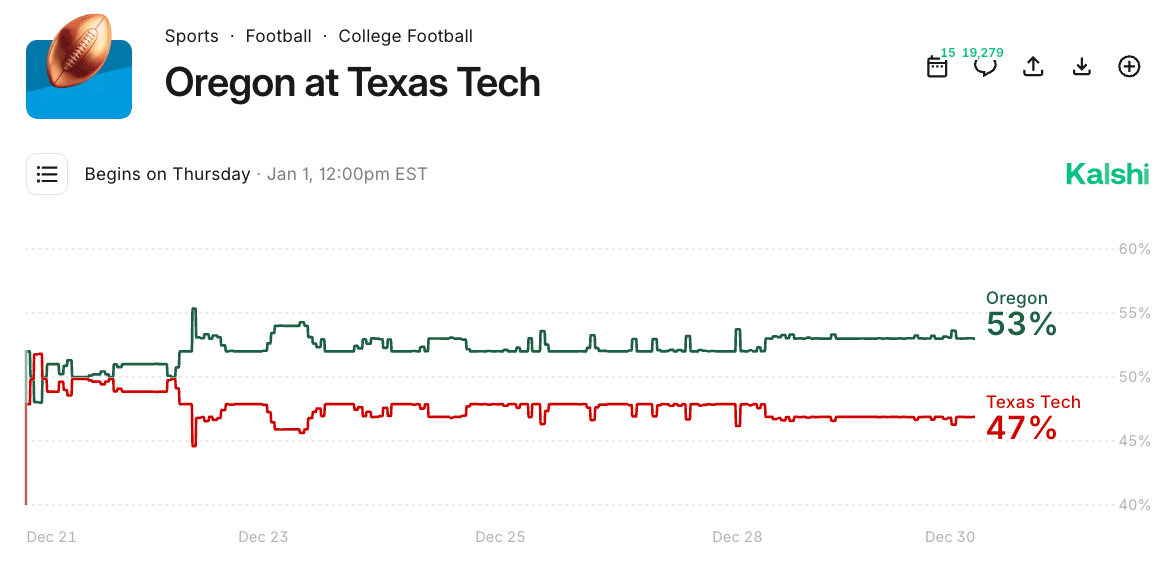

Backed by a trading volume greater than $663K, Kalshi traders give the University of Oregon a 53% chance at victory. Subsequently, UO is favored by 2.5 points. As for the set total, Kalshi’s traders list 52.5 combined points as the mark, wherein the over is priced at 47¢.

Head coach Joey McGuire and Texas Tech University have been away from the gridiron since they won the Big 12 title over BYU on December 6. Thanks to a prolific offense that scored 42.5 PPG, Tech earned its first conference championship in football since 1994, suffering only a narrow loss to Arizona State.

Oregon produced another respectable campaign in a competitive Big Ten circuit. With head coach Dan Lanning at the helm, mighty Oregon likes its chances whether playing in Eugene or not. UO has a suffocating secondary, giving up just 158.1 YPG passing in 2025, but can they slow down TTU?

The most entertaining action in this game will be Texas Tech’s defense matching up with Oregon’s offense. Notably, Oregon is powered behind the athleticism of quarterback Dante Moore, who has accounted for 30 total touchdowns this year. Moore will need to look out for senior Tech linebacker Jacob Rodriguez. In unique fashion, Rodriguez has filled up the stat sheet on both offense and defense; he’s tallied a team-high 117 tackles, 11 TFL, seven forced fumbles, four INT and two rushing touchdowns.

Kalshi’s traders had Texas Tech favored here as recently as December 21. TTU was priced at 52¢ at that time, but since then, Oregon has been viewed as the more likely victor. UO reached its market peak on December 22, when it was labeled with a 55.3% winning possibility.

All signs indicate that Oregon-Texas Tech will be the best game of the week. Personally, I am of that same impression.

For a New Year’s Day tradition like none other, the 112th Rose Bowl is sure to deliver. This year, No. 9 Alabama (11-3) is challenging No. 1 Indiana (13-0) at Pasadena’s famed venue—kickoff is slotted for 4 p.m. ET.

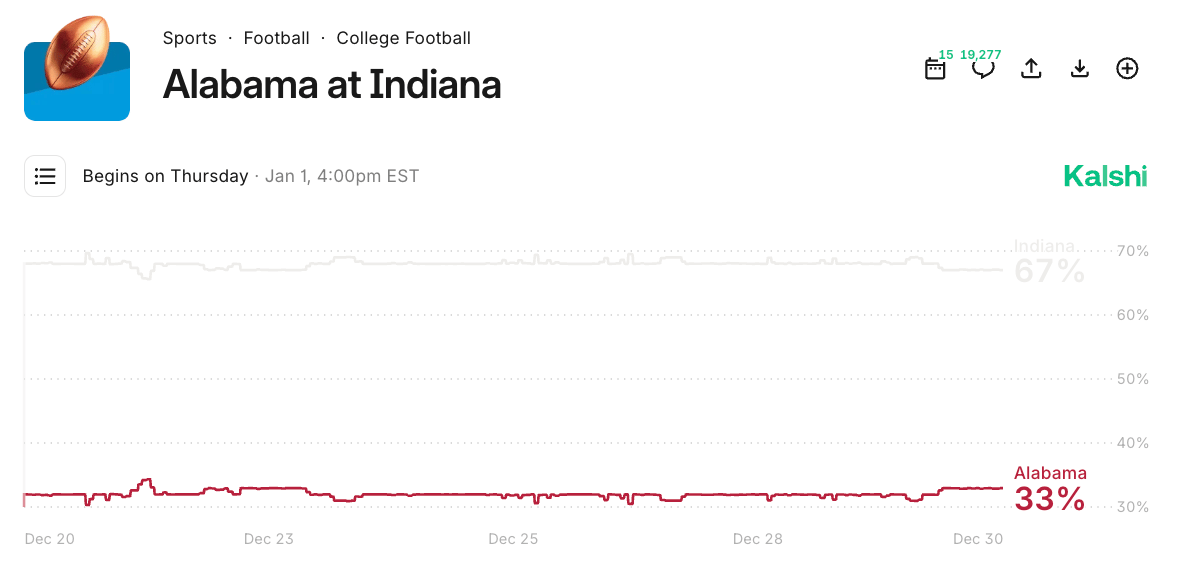

Of the four playoff contests this week, Alabama-Indiana has attracted the largest volume for Kalshi’s traders; that sum is approaching $1.25M on Monday afternoon. Within the market, Indiana yields a 69% likelihood to remain undefeated following Thursday. IU is favored by 6.5 points, which has “Yes” priced at 52¢. The total is currently placed at 48.5 points (Over 51¢).

Indiana football is arguably the top sporting story of the year. Be it quarterback Fernando Mendoza’s unlikely rout to the Heisman Trophy or head coach Curt Cignetti’s ability to fiercely reignite a program, Big Ten champion IU produced a campaign for the ages.

To the contrary, Alabama enters the Rose Bowl with perhaps the loftiest expectations in all of FBS. Bama is returning to Pasadena for its third time in six years. Notably, the 2024 loss to Michigan served as Coach Nick Saban’s final game. Back in the present, can head coach Kalen DeBoer and this group overcome odds by avenging the program’s previous loss in California?

From a scoring perspective, Indiana ranks top-five in FBS on both offense (41.9 PPG) and defense (10.8 PPG). In the conference title game versus Ohio State, it was IU’s pass rush that made the winning difference, issuing five sacks on Sayin.

Bama’s defense will seek to make life difficult for Mendoza at the Rose Bowl. Alabama has held others to just 168.4 YPG passing, which lands 10th in Division I. Mendoza has played here once (2023) while attending UC Berkeley, but that came against a much different opponent in UCLA.

Indiana wide receiver Omar Cooper, Jr. (ankle) is expected to be available for “The Granddaddy of Them All” after exiting the Big Ten championship. Cooper paced the team this season in both catches (58) and receiving yards (804). He’s also found the end zone on a dozen occasions in 2025.

The speedy Cooper could be exactly what IU needs to edge out Alabama—expect to see a contentious matchup in the secondary.

For an adversarial all-SEC affair, tune in Thursday at 8 p.m. ET to see No. 6 Ole Miss (12-1) and No. 3 Georgia (12-1) from Caesars Superdome. Keep in mind—Ole Miss lost to UGA in Athens as recently as October.

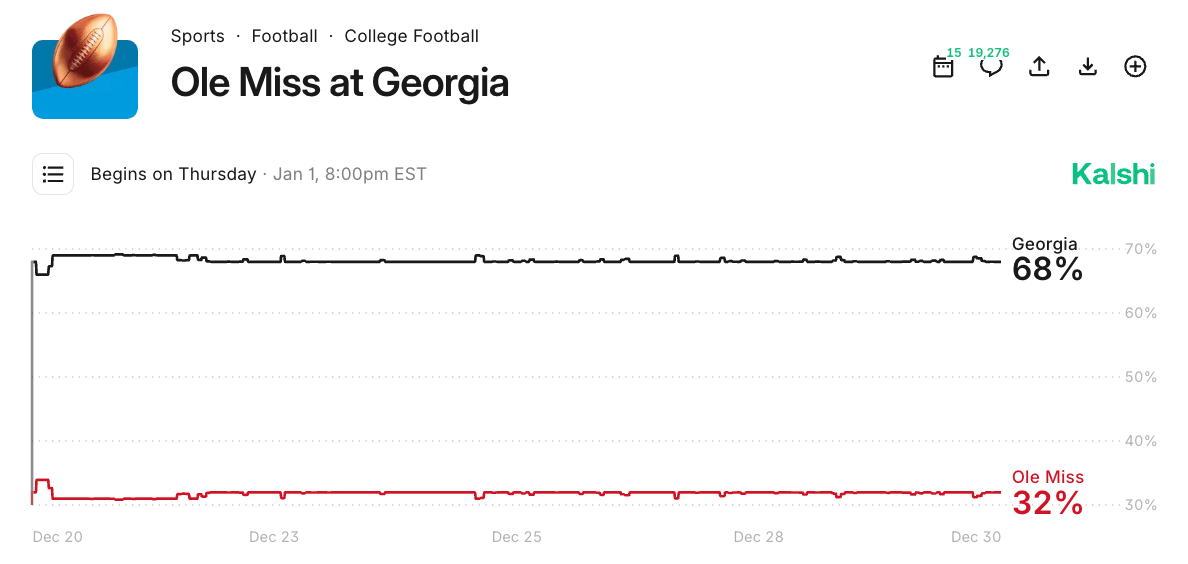

Kalshi’s traders have Georgia priced at 68¢ for victory in this second meeting with Mississippi. From there, UGA is predicted to win by 6.5 points. This contest also features the highest combined total of all playoff games in the second round: 56.5 (Over 50¢).

Two-and-a-half months ago, Georgia outdueled Ole Miss, 43-35, in a bid that showcased more than 860 yards of offense. Regardless, that came at a time when Mississippi was under the guidance of Coach Lane Kiffin, which is no longer the case.

UGA head coach Kirby Smart and quarterback Gunner Stockton will look to attack Ole Miss through the air once again. Stockton tossed four touchdowns while completing 83.9% of his pass attempts when he last saw the Hotty Toddy defense.

According to ESPN’s SP+ scale, SEC-champion Georgia (5) is positioned just one spot ahead of Ole Miss (6). On that same list, Mississippi is viewed as the better offense by a noticeable margin.

Ole Miss will hope to lean on the dual-threat abilities of senior signal caller Trinidad Chambliss. In unison with running back Kewan Lacy (5.0 yards per rush), Chambliss’ running talents have helped power one of the top units in college football. Can UGA hope to outlast them for a second time?

Georgia’s defense will make all the difference in this matchup. Much to the dismay of Ole Miss, UGA has surrendered only 79.2 YPG on the ground in 2025, landing as the fourth-best clip in FBS. Mississippi will need to operate around Georgia linebacker C.J. Allen—the junior defender has made a team-high 85 total tackles (eight TFL).

The all-time record between these conference foes stands at 34-14-1 in favor of UGA. However, they have alternated wins and losses over their past four meetings.

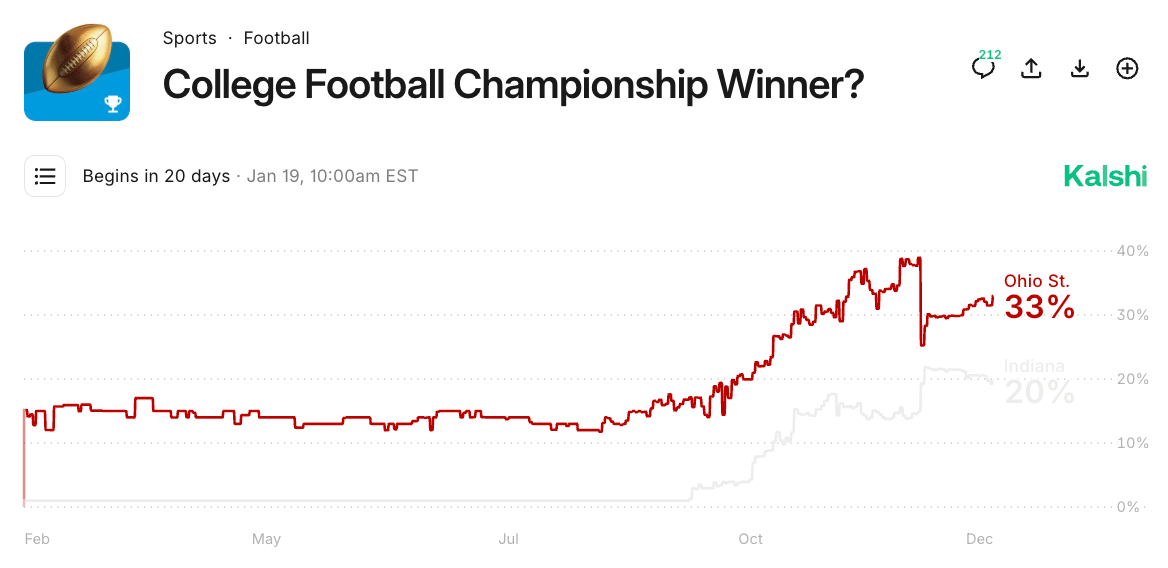

Much like last week, Ohio State is viewed by Kalshi’s traders as the national-title frontrunner. OSU shows a 33% chance to win back-to-back college football championships. They have not dipped below 26% here since the day after losing the Big Ten championship. In that same vein, Indiana is still yielding respectable support, showing a 20% possibility to go the distance.

Subsequently, Georgia (18%), Oregon (11%) and Texas Tech (10%) are the only other programs priced at 10¢ or higher. If looking for lengthy value, Alabama is available for six cents while Miami (4%) and Mississippi (3%) round out the bottom.

The four winners from New Year’s Eve and New Year’s Day 2026 will be propelled to college football’s semifinal round, earning either a trip to Atlanta or Glendale, AZ. Get your popcorn ready. The fun has only just begun.

The takeaway

Kalshi markets now forecast:

Ohio State is predicted to defeat Miami (FL): 75%

Oregon is predicted to defeat Texas Tech: 53%

Indiana is predicted to defeat Alabama: 68%

Georgia is predicted to defeat Mississippi: 68%

National title odds:

Ohio State: 33%

Indiana: 20%

Georgia: 18%

Oregon: 11%

Texas Tech: 10%

Alabama: 5%

Miami (FL): 4%

Ole Miss: 3%

Follow Gabriel Santiago on Instagram: @ByGabrielSantiago

Follow Kalshi on X: @Kalshi

Image Source: Itsschneebly

The opinions and perspectives presented in this article belong solely to the author. This is not financial advice. Trading on Kalshi involves risk and may not be appropriate for all. Members risk losing their cost to enter any transaction, including fees. You should carefully consider whether trading on Kalshi is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk. Information is provided for convenience only on an "AS IS" basis. Past performance is not necessarily indicative of future results. Kalshi is subject to U.S. regulatory oversight by the CFTC. Kalshi is not affiliated with, endorsed by, or sponsored by any college, conference, athletic organization, league, broadcaster, or event referenced. References to teams, schools, conferences, leagues, events, or broadcasts are for informational purposes only. All trademarks, logos, and names are the property of their respective owners.