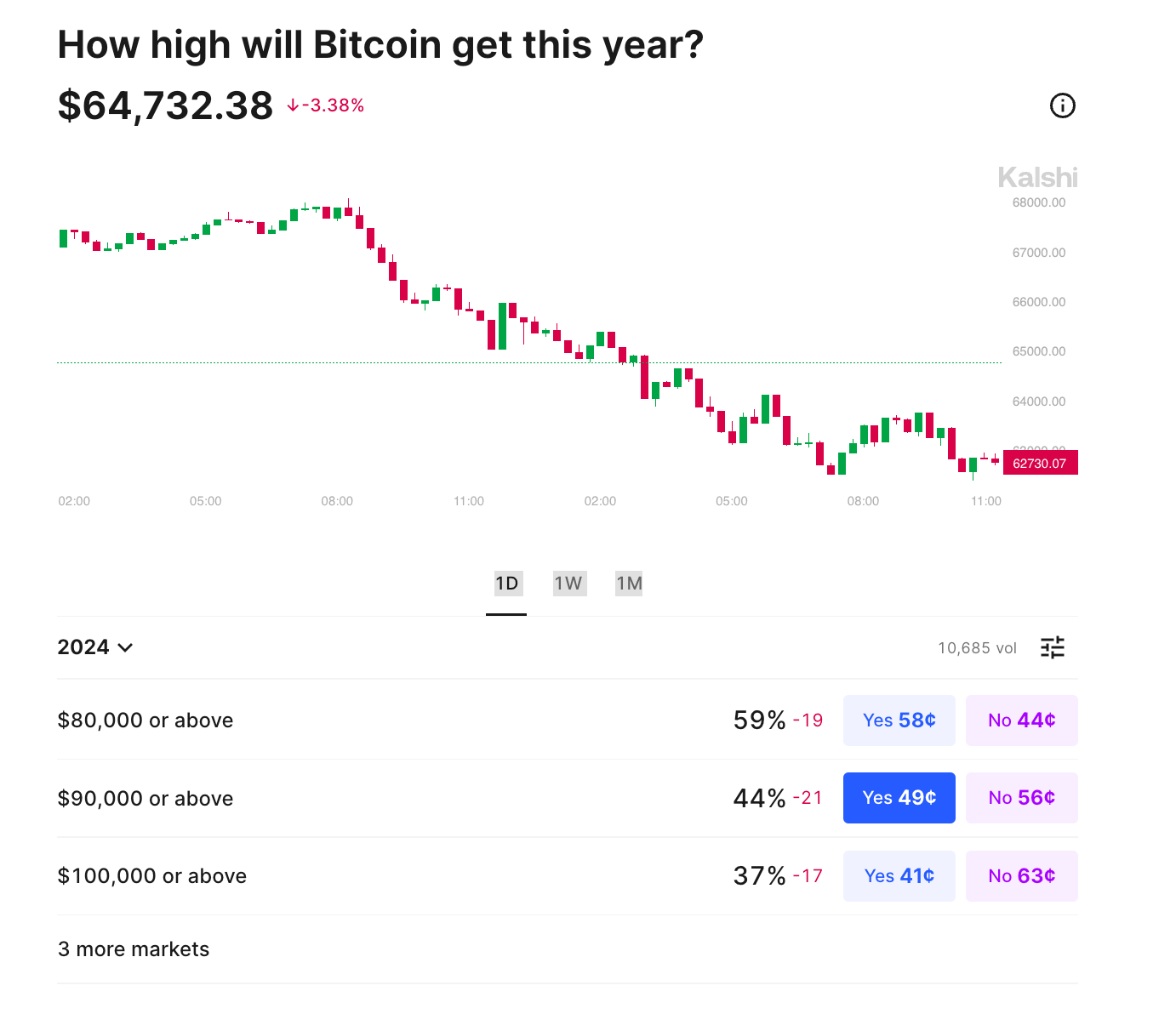

We just launched the first regulated event contracts on Bitcoin and other cryptocurrencies. You can now bet directly on questions like:

Bullish or bearish, most people probably have a strong opinion about Bitcoin price, so we decided to offer a way for people to bet on that opinion and catalyze on it in a super simple way that fits that opinion… without actually owning or buying crypto.

How does it work?

Crypto event contracts are incredibly simple: if you believe BTC will hit 100k this year, you can bet on it by buying Yes shares at 41c (see picture above). If you are right, each share will pay out $1, and you make money. If you are wrong, each share will pay out $0 and you lose money. See the table below for an example of buying 1,000 shares of BTC, and reaching 100k or more.:

# shares

Price

Cost

Payout if you win

Payout if you lose

1,000

41c

$410

$1,000 (+$581)

$1,000 (-$410)

The markets will settle against the CF Benchmarks' Bitcoin Real-Time Index (BRTI). See full market specs here.

How are prices determined?

Like any other financial market, the prices are determined by the supply and demand in the market. The easiest way to think about price is to consider the odds (or % chance). In the example above, the price is 41c, which means the market thinks there is a 41% chance that BTC will hit 100k this year. The higher the price, the more likely an event is. The lower the price, the less likely.

Other participants are constantly adapting their prices based on what they think is the chance that an event will happen.

You might be thinking: Why?

There are many ways to buy and trade crypto: spot, futures, options, OTC, etc. So you might be asking: what is different about this market?

There are a few reasons, but the TDLR is simple, both in terms of structure and access.

Bet on your opinion without touching crypto

While the crypto community has grown like crazy, it’s still not a majority of Americans. Yes, we hear about crypto all day, but that’s because we’re often stuck in our niche bubble of tech shills and finance bros. Most Americans are still averse to touching crypto: they don’t understand it fully and don’t want to understand it fully.

The set of people who have strong opinions about crypto is bigger (might be much bigger) than the set of people who understand crypto and know how to transact in it.

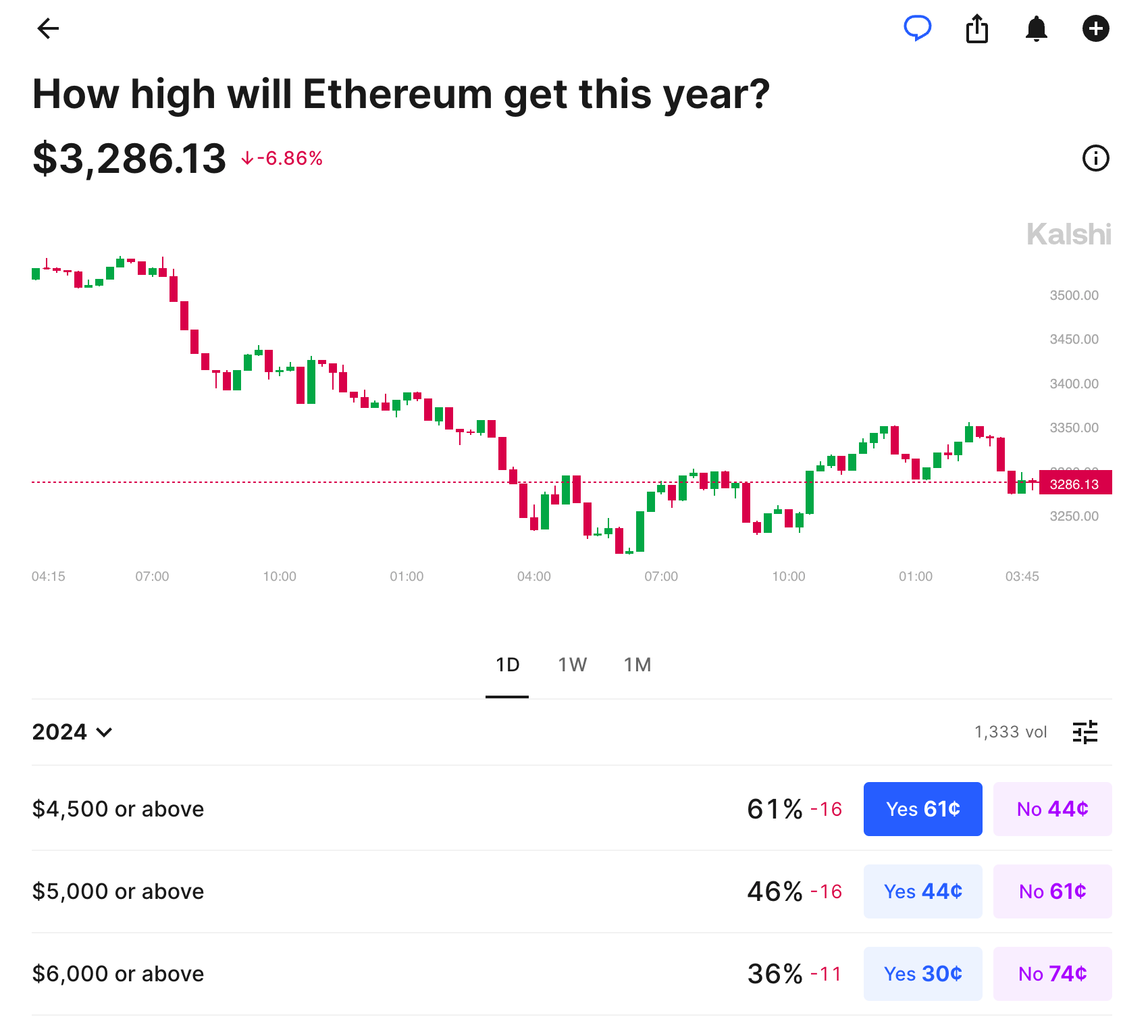

Take a position on how high Ethereum will get this year. Bearish on crypto? Look to purchase No contracts on these markets!

This is especially true for crypto bears and people who want to bet against the entire “crypto thing.”

Our markets are a great way to bet against crypto (or bet for crypto) without owning cryptocurrency altogether. This may enable participation from an untapped piece of the market that has views about crypto but is sitting on the sidelines.

“What about options and futures?” You might ask. The response here is obvious: if you’re not touching a spot on Coinbase, you are most definitely not getting into the complexity of options, let alone futures. I run a regulated financial exchange and I still have to do the math in my head whenever I have to think about options (and I have never traded futures because the access requirements are too heavy). A simple way to buy Yes or No on your conviction is cleaner and more natural.

Leverage, without margin

The binary nature of the contracts offers significant leverage on your view. Let's say BTC is currently trading at $66,800 and you believe that it will hit $69,000 by the end of the day. Unless you’re an ultra-advanced trader, you have 2 options: Buy BTC spot OR buy Kalshi Markets.

Buying BTC:

Buy 1 bitcoin at $66.8k per BTC

If Bitcoin hits 69k, you make 2.2k in profit and a 3.2% return

Buying Kalshi market:

Buy 10k Kalshi shares at 10c per share. You pay $1,000 to acquire these shares

If Bitcoin hits $69k, you make $9k in profit and a 900%…

If you’re looking to buy and hold crypto, Kalshi markets are not a good fit. But if you have a directional view, Kalshi Markets might be a significantly more capital-efficient way to express your opinion.

Also, it might be less risky even if your payout is binary….

Why? Because you know the max you can lose up front. ($1,000 in the example above). If you buy BTC spot outright, while you don’t expect it to move much in normal market conditions (not more than 2-3% daily), you can lose much more than 2-3% if an adverse price movement happens: eg.

This is not the case if you buy BTC: you could lose much more than you expected. For example, Bitcoin dropped 10% yesterday, so you would have lost ~7k. Your value at risk (Var) is higher and harder to define.

Safe, regulated, and legal

Crypto does not mean shady. It does not mean rug pulls. It does not mean stealing customer funds. Crypto is a great financial instrument, but like any instrument, it can be used to scam people.

Or, it can be done the right way… Kalshi is federally regulated. We use a regulated clearinghouse. We safeguard your funds in a segregated account. We have market integrity and customer protection measures.

You can trade crypto without the risk that your funds will be pulled away from you.

Take trading risks, but don’t take custody, funding, and fraud-type risks.

What if I’m sophisticated/advanced and already trade derivatives:

Great! You can use our markets to get differentiated exposure to crypto because of their different structure. And given the nascency, you will also likely find good arb opportunities.

Market Structure & Access

Liquidity:

Liquidity is ramping up on these products. A few small funds are currently providing liquidity on the exchange. Over the next few weeks, liquidity will ramp up significantly when our institutional market-making partner starts quoting our crypto markets (they’re currently available in some of our financials and economics markets).

Incentives and rebates:

We are currently offering temporary incentives for people to join and trade on our markets. You can get paid up to 1.4% rebates on your volume for a temporary period.

Tier

Weekly Volume

% Rebate

Tier 1

$12,500

0.625%

Tier 2

$25,000

0.875%

Tier 3

$62,500

1.000%

Tier 4

$125,000

1.125%

Tier 5

$312,000

1.400%

For Advanced Traders:

We offer API trading via REST and Websockets. Through Kalshi's API, you’ll gain access to information about your own orders, trades, portfolio, and portfolio history, as well as all markets’ order books and a limited number of stats about each of them. The API will also give you access to public information on the exchange, like market data.

Currently, we are working on finalizing FIX: for more info, contact us at [email protected]

The opinions and perspectives presented in this article belong solely to the author(s). Trading on Kalshi involves risk and may not be appropriate for all. Members risk losing their cost to enter any transaction, including fees. You should carefully consider whether trading on Kalshi is appropriate for you in light of your particular circumstances, investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk. Past performance is not necessarily indicative of future results. No representation is being made that any account will or is likely to achieve profits or losses similar to any described. Any research views expressed represent those of the individual author and do not necessarily represent the views of Kalshi or its affiliates. Any demonstrative examples are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. While Kalshi strives to provide accurate and timely information, there may be inadvertent inaccuracies, errors and omissions, for which we apologize and expressly disclaim any liability. We reserve the right to make changes and corrections at any time, without notice. The content is provided on an "AS IS," "AS AVAILABLE" Basis. Any information denoting past or historical performance is not indicative of future performance and no reliance shall be placed on such information.